Note: This article notes that the term “Electric Vehicle” also includes Hybrid vehicles.

The electric vehicle (EV) market has now become an integral part of our lives. In countries like the USA, Germany, the UK, China, Hong Kong, and South Korea, many vehicles accessed through Uber, Lyft, and taxis… have already transitioned to EVs, directly showcasing the shift. As global EV sales set new records, China, the USA, and Germany are at the forefront of this innovative change. These countries are leading the expansion of the EV market through distinct policies and technological advancements, facing numerous challenges and opportunities along the way.

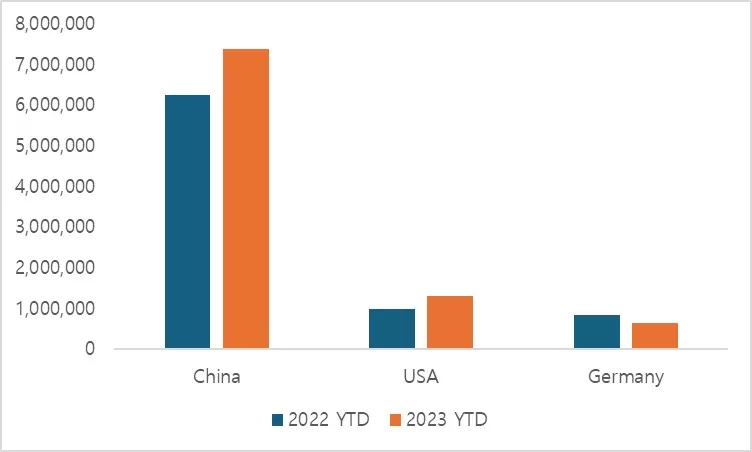

Despite a reduction in EV subsidies, China still dominates the global EV market, accounting for approximately 60% of worldwide sales. The USA is fostering the growth of the EV industry through various tax benefits and government policies. However, a significant shift occurred in January 2024 when the IRS announced a reduction in the number of models eligible for EV tax credits from 43 in 2023 to 19. Germany, having ended its subsidy program in December 2023, faces uncertainty regarding its ability to maintain a high growth rate similar to China.

Part 1 of this document will compare the sales volumes and policies of the top three EV-selling countries (China, the USA, and Germany). Part 2 will analyze the growth rates and OEM market share changes in countries where over 100,000 EVs were sold in 2023. Finally, the insights section will discuss future prospects.

- EV Sales Volume Top 3 Countries (China, USA, Germany) – Part 1

- Comparison of China’s EV policy and sales volume

- Comparison of the USA’s EV policy and sales volume

- Comparison of Germany’s EV policy and sales volume

- Comparison of Countries with Sales Over 100,000 – Part 2

- Year-over-year sales volume comparison

- Analysis of sales growth rate and market share

- Implication – Part 1/2

EV Sales Volume Top 3 Countries (China, USA, Germany)

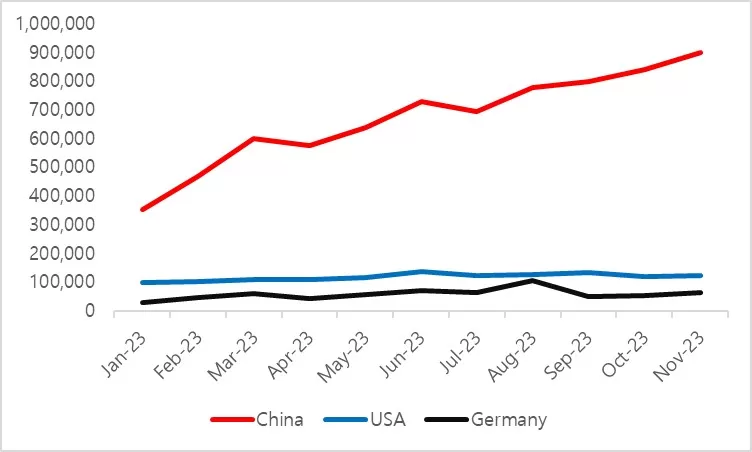

(Exhibition 1. 2023 Jan ~ Nov EV sales)

(Exhibition 2. EV sales 2022 YTD 2023 YTD)

China’s EV Policy and Sales Volume Comparison: Starting in 2024, China will implement a new purchase tax policy for New Energy Vehicles (NEVs). Purchases of NEVs from 2024 to the end of 2025 will be exempt from purchase taxes, with the exemption amount not exceeding 30,000 yuan per vehicle. From 2026 to the end of 2027, the purchase tax will be halved, with the reduction not exceeding 15,000 yuan per vehicle. This policy applies to various forms of NEVs, including battery electric vehicles, fuel cell electric vehicles, and extended-range electric vehicles (EREVs).

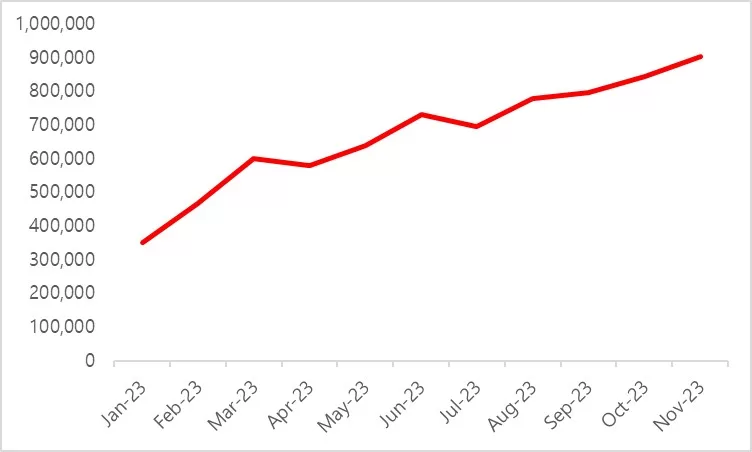

Initial Growth (January – March): The start of 2023 saw significant growth, with 351,647 EVs sold in January alone. This was followed by a sharp increase in February and March, with 466,789 and 599,636 vehicles sold, respectively, attributed to the synergy of the Chinese government’s New Year subsidy policy and market promotion measures.

Stable Growth (April – July): Although there was a slight decrease in April with 578,046 vehicles sold, May and June saw a resurgence in sales, with 640,245 and 730,869 vehicles sold, respectively. July faced a brief adjustment period with 696,122 vehicles sold, during which the Chinese government continued to expand investment in the EV industry and strengthen infrastructure development.

Rapid Increase (August – November): The EV market in China experienced notable growth from August to November. Sales rose again in August, with 777,476 vehicles sold, and continued to increase steadily through September, October, and November, with sales reaching 797,635, 842,426, and 901,825 vehicles, respectively. During this period, the Chinese government increased incentives for EV purchases and expanded the EV charging infrastructure to promote market growth.

(Exhibition 3. CHINA EV sales 2023.01~2023.11)

USA’s EV Policy and Sales Volume Comparison: According to the Inflation Reduction Act (IRA), starting in 2024, new electric vehicles produced in North America will be eligible for a subsidy of up to $7,500. This policy, aimed at reducing carbon emissions and stimulating the US economy, has strict criteria for subsidy eligibility. The reduction in the number of qualifying models to 19, excluding electric vehicles from Korean companies, is due to the IRA’s tightened requirements on critical minerals and battery components. This policy change is expected to significantly impact the structure and competitive landscape of the US EV market.

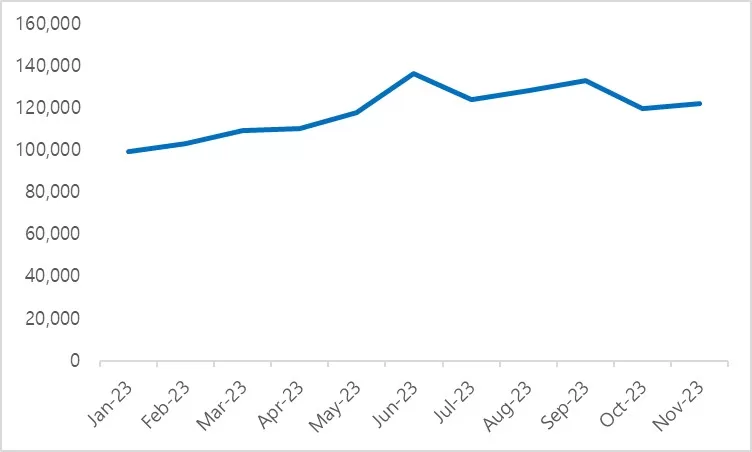

Gradual Growth (January – June): The US began 2023 with 99,436 EVs sold, growing to 136,287 vehicles by June. This steady growth, particularly noticeable in June, was influenced by active summer buyers and the launch of new models.

Volatility (July – November): Sales slightly decreased in July to 124,159 vehicles but stabilized by November, with 122,005 vehicles sold. During this period, the introduction of new EV incentive policies in various states positively impacted sales.

(Exhibition 4. USA EV sales 2023.01~2023.11)

Comparison with China:

- Sales Growth Rate: China’s EV market exhibited a higher sales growth rate in 2023, driven by aggressive market promotion and subsidy policies from the Chinese government. In contrast, the growth in the US has been gradual, with government policies not as aggressive as China’s.

- Policy Support: China provides extensive government support to strategically cultivate the EV industry, contributing directly to an increase in EV sales. The US offers various incentives at the federal and state levels but lacks the consistency and scope of China’s policy execution.

Germany’s EV Policy and Sales Volume Comparison: Germany’s electric vehicle subsidy policy ended on December 18, 2023, anticipating significant changes in EV and PHEV (Plug-in Hybrid Electric Vehicle) sales. The termination of the subsidy policy is expected to lead to a decrease in electric vehicle sales, especially among corporate purchases, potentially slowing overall market growth. This shift may also affect Germany’s EV exports and lead to an increase in demand for low-cost electric vehicles, intensifying price competition.

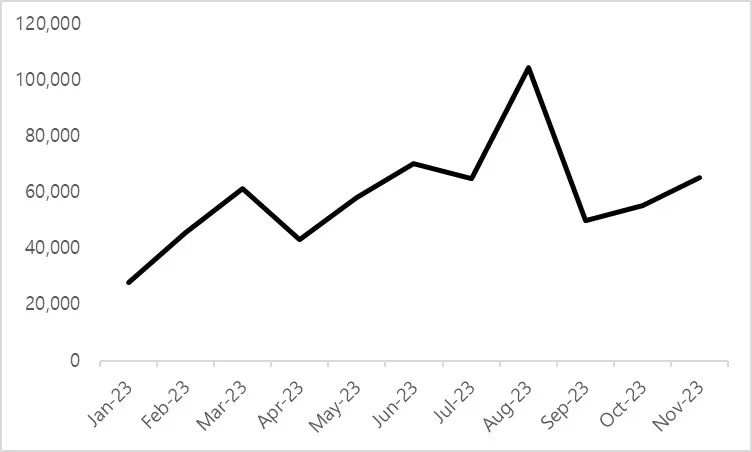

Volatility and Growth: The EV sales volume in Germany began at 27,881 vehicles in January 2023, surged to 104,365 vehicles by August, and then experienced some irregular volatility. The termination of the electric vehicle subsidy policy on December 18 is expected to significantly change EV and PHEV sales within Germany.

(Exhibition 5. Germany EV sales 2023.01~2023.11)

Comparison with China and the USA:

Growth Rate and Market Trends: Despite being relatively smaller in scale, Germany’s EV market has shown a rapid growth rate comparable to China. In contrast, the US’s growth pattern is more gradual, with total sales higher than Germany’s.

Policy Support: Germany’s policy support is more targeted and segmented compared to China’s extensive and intensive support, focusing on technological innovation and infrastructure development for sustainable mobility. The US offers various incentives at the federal and state levels, with a decentralized approach that varies by state.

Implication

China’s Market Leadership: China dominates the bulk of global EV sales, steering the market with its subsidy policies and continuous support for New Energy Vehicles (NEVs). The changes in China’s policies are anticipated to have a significant impact on the global market, serving as an important reference point for policy-making in other countries.

US Policy Changes and Market Structure: The alterations in the US tax credit policy are reshaping the market by fostering preferences for certain models and encouraging domestic production. These changes are expected to influence not only the growth of the EV industry within the US but also international cooperation and competition.

Impact of the Termination of Germany’s Subsidy Policy: The cessation of Germany’s subsidy policy may lead to a short-term decline in sales, but in the long run, it could provide opportunities for a more competitive market and technological innovation. The developments in the German market will offer significant insights for the EV industry across Europe.

Future Outlook for the Global EV Market: As global EV sales continue to rise, policies and market conditions in various countries will evolve continually. Technological innovation, international cooperation, and policies aimed at sustainable development will play crucial roles. Particularly, the increasing demand for affordable electric vehicles will open new market opportunities, emphasizing the importance of developing models with competitive pricing.