Zero Beverage Innovation, Product Development, and the Reasons Behind Competition and New Entrants

Just a decade ago, the health hazards of sugary drinks weren’t as widely recognized as they are today. The introduction of Diet Coke led many beverage companies to launch a variety of drinks using sweeteners. Currently, the term “Zero” is marketed to consumers as a healthier food product not using sugar, instead of “Diet.”

This article will analyze which companies are being developed, how the competitive landscape looks, and who the new startups entering the Zero Sugar beverage market are.

- Zero Beverage Innovation and Product Development

- Reasons Behind Competition and New Entrants

- Implications

1. Zero Beverage Innovation and Product Development

The Zero Sugar beverage market has experienced explosive growth in innovation and product development in recent years. As consumer interest in health rises, people are searching for healthy alternatives without added sugar, prompting major companies to introduce a variety of Zero Sugar drinks.

According to BeverageDaily, PepsiCo launched a lemon-lime flavored soda called ‘Starry’ in 2023, available in both regular and Zero Sugar versions in U.S. retail stores and food service outlets. Brisbane-based Mandatory Spirit Co. has released spirits in 1.5L boxes, claiming significantly reduced carbon footprint compared to glass bottles. These new beverages are sugar-free, gluten-free, vegan, and each has a unique taste profile. The company’s packaging is made from 100% recyclable materials.

Coca-Cola is introducing a variety of Zero Coke series through collaborations with different companies. Recently, they launched a new Zero Sugar drink, ‘Coca‑Cola® Y3000 Zero Sugar,’ in collaboration with artificial intelligence.

Beverage companies not only consider consumer health through Zero Sugar but also provide diverse experiences through various collaborations.

2. Reasons Behind Competition and New Entrants

2-1 Reasons Behind Competition

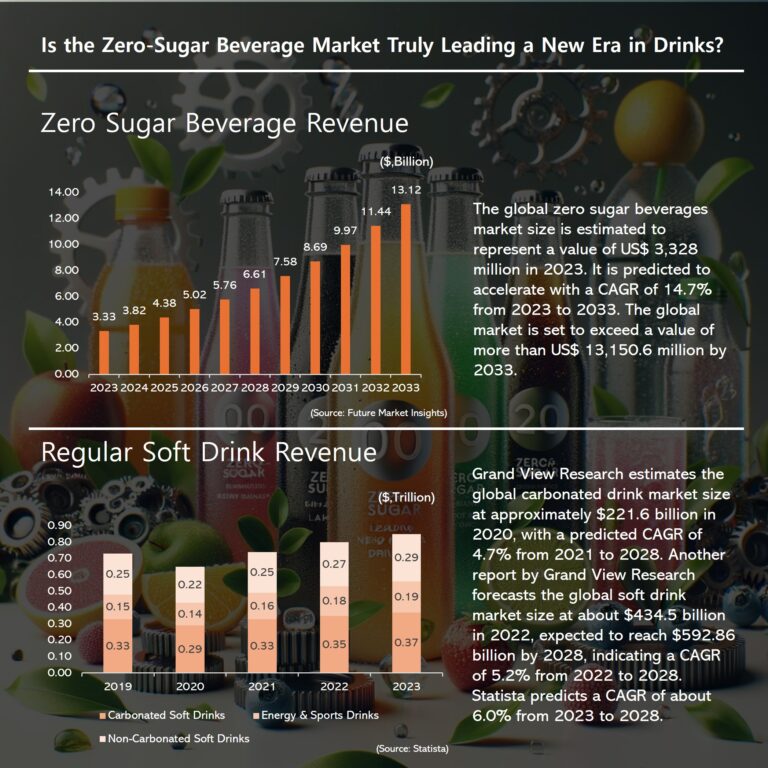

According to Report Linker, the global beverage market is expected to accelerate from $3.328 billion in 2023 to over $13.151 billion by 2033, with a projected CAGR of 14.7% during this period.

A 2023 food and health survey conducted by the International Food Information Council on over 1,000 U.S. consumers revealed that the majority (72%) aim to limit or avoid sugar.

Consequently, every beverage company will take significant interest in Zero Sugar drinks and launch new products for consumers.

This survey indicates the crucial role of sweeteners used instead of sugar. Developing and finding sweeteners that can mimic sugar as closely as possible has become a major task for large beverage companies.

2-2 New Entrants

New startups have emerged, introducing products like plant-based sweeteners. GreyB that Roquette and its German biotech partner BRAIN are preparing to launch the plant-based sweetener Brazzein into the market, naturally found in African berries and specifically developed for the beverage industry. Additionally, Israeli startup Better Juice is expanding its sugar reduction solutions in partnership with German process engineering company GEA. This technology uses natural ingredients to convert fructose, glucose, and sucrose into prebiotic dietary fibers and other non-digestible molecules, reducing sugar in orange juice by up to 80%.

3. Implications

It’s no exaggeration to say that all beverage companies have Zero Sugar drinks in mind. How Zero Sugar beverages are marketed will determine their ability to attract consumer interest. Providing new experiences, not just health benefits, is essential to leading the Zero Sugar market. These new experiences could include maintaining customer relationships through collaborations, conveying messages through new Zero Sugar bottle designs, and more.