Is the Zero-Sugar Beverage Market Truly Leading a New Era in Drinks? Part (1/2)

*Note, this article does not concern beverage with alcohol.

Beverages adopting low-calorie sweeteners are gaining considerable attention by replacing the term ‘diet’ with ‘Zero Sugar’ in their brand names. Many consumers prefer ‘Zero Sugar’ drinks with sweeteners over sugary beverages due to the pursuit of a healthier lifestyle and social and cultural factors. Leading global companies such as Coca-Cola, PepsiCo, Monster Energy, Red Bull, and Arizona, along with new startups, are quickly launching new products.

In Part 1, we’ll examine the growth of Zero Sugar beverages compared to regular beverages:

- Comparison of Zero Sugar Beverages and Regular Carbonated Drinks

- Consumer Perception

- Implications

Part 2 will analyze the companies developing these beverages, the competitive landscape, and identify the startups entering the Zero Sugar drink market:

- Zero sugar Beverage Innovation and Product Development

- Competitive Landscape and New Entrants

- Implications

1. Comparison of Zero Sugar Beverages and Regular Carbonated Drinks

1-1 Low/Zero Sugar Beverage

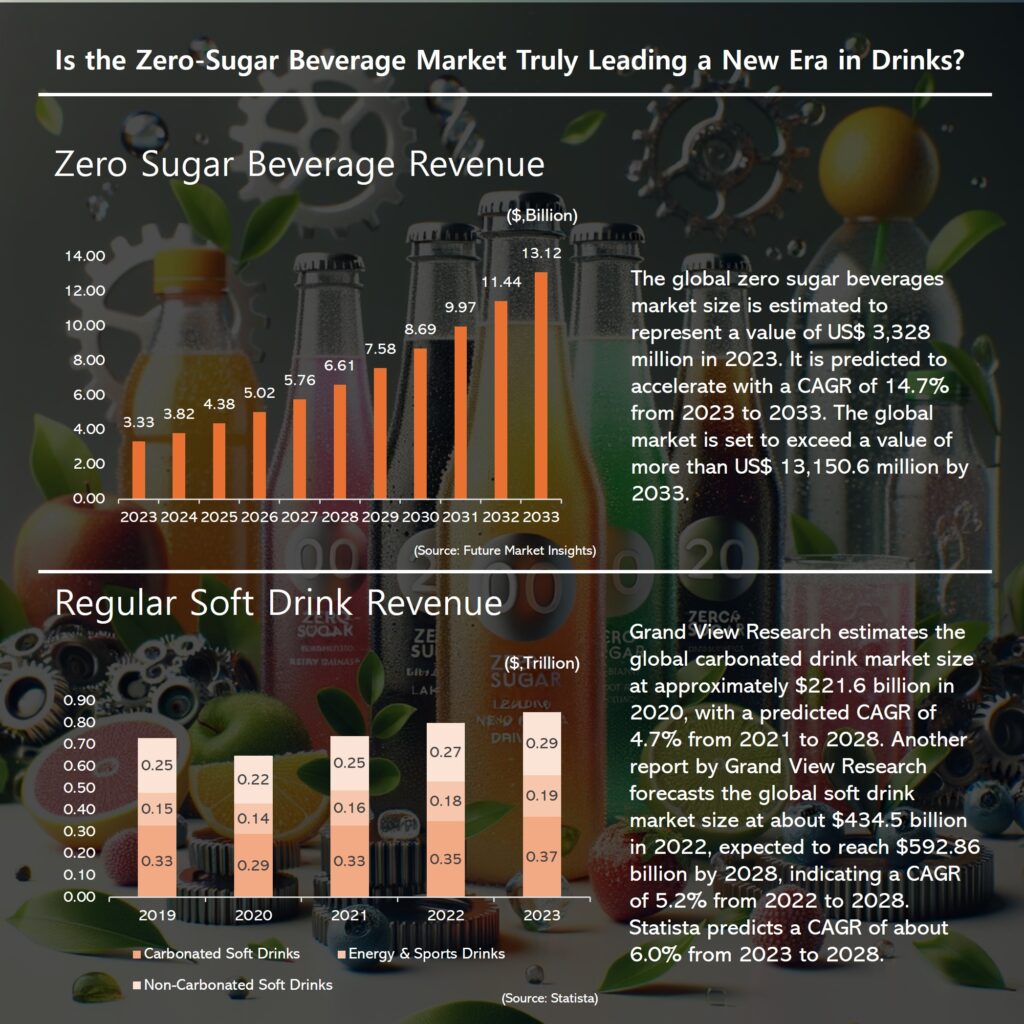

Future Market Insights estimates the global Zero Sugar beverage market size at $3.328 million in 2023, predicting a Compound Annual Growth Rate (CAGR) of 14.7% from 2023 to 2033, exceeding $13,150.6 million by 2033. According to Allied Market Research, the global sugar-free beverage market was valued at $12.53 billion in 2020, expected to reach $24.35 billion by 2030, with a CAGR of 7.3% from 2021 to 2030. This data indicates rapid growth in the Zero Sugar beverage market, driven by increasing consumer health awareness and demand for natural ingredients. The market’s growth suggests consumers are seeking healthier alternatives, and beverage manufacturers continue to innovate to meet this demand.

1-2 Regular Beverage

Grand View Research estimates the global carbonated drink market size at approximately $221.6 billion in 2020, with a predicted CAGR of 4.7% from 2021 to 2028. Another report by Grand View Research forecasts the global beverage market size at about $434.5 billion in 2022, expected to reach $592.86 billion by 2028, indicating a CAGR of 5.2% from 2022 to 2028. Statista predicts a CAGR of about 6.0% from 2023 to 2028. Variations in these data points reflect the unpredictable growth rates due to consumer surveys, increasing health awareness, alternatives to beverages, and rising sugar taxes in various countries.

2. Zero-Sugar Consumer Perception

Consumers prefer healthier beverages over traditional carbonated drinks, indicating that legal restrictions and taxes on beverage sales negatively impact traditional Carbonated Beverages (CSD) sales. Many manufacturers introduce new products, including zero and low-calorie carbonated drinks and non-carbonated options, to meet the demand of health-conscious consumers. (https://www.bevindustry.com/articles/95943-2023-state-of-the-beverage-industry-consumers-call-for-low-or-zero-sugar-carbonated-soft-drinks) Tasting Table provides insights into how consumers feel about popular Zero Sugar beverages, evaluating options like Sprite Zero Sugar and Pepsi Zero Sugar. These beverages target the health-conscious market but often leave consumers craving their regular versions. Zero Sugar beverages with added sweeteners can’t perfectly mimic traditional beverages, but companies are making various attempts to replicate over 90% of the taste. Some companies view Zero Sugar and regular beverages as entirely different concepts.

3. Implications

The growth rate of Zero Sugar beverages significantly surpasses that of traditional beverages. As consumers become more health-conscious, the demand for Zero Sugar beverages will increase. Personal experience suggests a shift away from regular cola towards Zero Sugar options as health and diet concerns grow. Despite some dissatisfaction, consumers continue to choose Zero Sugar versions of their favorite brands, driven by media, articles, blogs, and doctors emphasizing the risks associated with carbonated drinks. Defining “tasty” can be challenging, but the notion of health benefits reinforces the appeal of Zero Sugar beverages, likely replacing regular beverages and emerging as a distinct category. The demand for health-related drink markets is expected to rise significantly.